Countless plans exist to solve affordable housing, nearly as many as the homes needed to end homelessness. I’m not proposing a catch-all solution but a specific, scalable, long-term approach that goes beyond simply “housing the unhoused,” as many proposals assume will suffice. Without a comprehensive, community-centric, homeownership-based design offering sustainable pathways for those experiencing homelessness, any plan will fail—or require unsustainable financial support. Community partnerships, especially for mental health and addiction treatment, are vital, as more than two-thirds of the homeless population face these challenges. Three critical elements can create a self-sustaining housing model, replicable nationwide, leveraging private capital and public funds efficiently:

- Community focus

Community-focused design varies by region, and the Austin, Texas, Community First Village is an excellent example. This facility’s intentional design includes centralized kitchens, multiple gathering areas, and according their website, “Each home has a front porch, and homes are clustered around common areas with laundry rooms, restroom and shower facilities, outdoor community kitchens, and green space. These shared areas encourage interactions among neighbors, helping them form relationships and build community.” While Texas’ warm climate supports open-air gathering spaces, colder climates could adapt by moving these areas indoors, with covered walkways connecting homes and community hubs.

- Home ownership

Homeownership, and the wealth-building equity it creates, is essential to lifting people out of poverty into sustainable, healthy lives. Manufactured housing is the most efficient way to achieve this. These homes have ownership documents separate from the land, allowing owners to legally own their home while leasing the land—a model common in mobile home and RV parks. By establishing communities of independently owned manufactured homes, formerly homeless individuals can build wealth over time. Manufactured homes offer the same tax advantages as traditional stick-frame homes, including equity growth through mortgage principal payments, home price appreciation, and potential capital improvements, all in a tax-advantaged manner.

- Onsite dignified income

While homeownership is more than just receiving a home, residents must be invested in their community and take pride in owning and maintaining their homes. They also require income to sustain it. Unfortunately, however, nearly 60% of homeless individuals cannot secure conventional jobs. Onsite employment offers a proven solution. At Community First Village, for example, the Community Works program’s Dignified Income initiative is key. Their website states, “Community Works provides opportunities for individuals who have experienced homelessness to rediscover purpose and apply their God-given talents to earn a dignified income. The program empowers Mobile Loaves & Fishes volunteers to serve alongside our friends as they develop new skills, while also cultivating enduring relationships.” Opportunities include gardening, art studios, food services, an inn, an auto shop, and a cinema.

These micro-enterprises allow residents to earn income onsite that accomplishes many goals at once: support their housing costs, build home equity, and foster pride and accomplishment. Flexible work hours—such as early mornings for artists or seasonal farming—accommodate non-standard schedules, aiding those unable to work a typical 9-to-5 job. Contractor-style payments also provide tax advantages over standard payroll. Unlike solutions that merely place people in housing units without addressing long-term needs, onsite income strengthens community belonging, encourages home care, and provides true sustainability.

Why isn’t this being done?

It is being done—small-scale projects incorporating these elements exist nationwide. However, owners and operators most lack the expertise to navigate real estate development, long-term management, and sustained community partnerships. Instead, this expertise resides in the private sector. Without financial incentives, however, private real estate professionals are unlikely to engage. This means that short of a sudden philanthropic surge, incentives are needed to tap this resource.

Fortunately, the elements of a sustainable, replicable project align with those who require viable financial returns, because homeownership allows homes to be financed independently from land development. As shown in the tables below, even modest rents and home sale values, combined with private lending, can generate strong returns. Since these developments create familiar assets (mobile home parks), long-term financing options are plentiful, freeing capital for future projects.

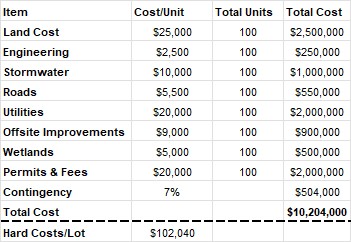

Table 1. Development costs for a 100-unit community; estimate based on recently completed Bridgeview Asset Management development in NW Washington.

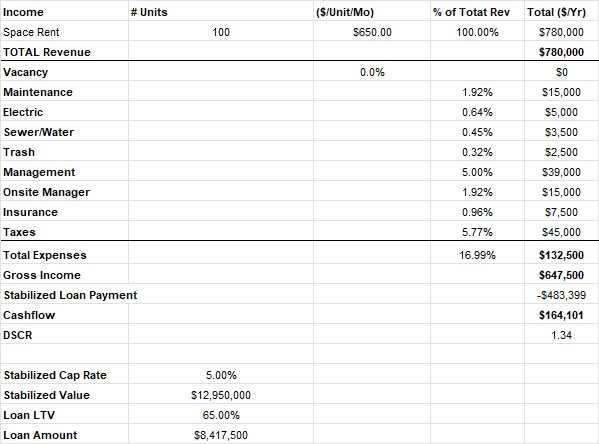

Table 2. Operating analysis; assumes rent level at 60% of market, tenant paying all utilities.

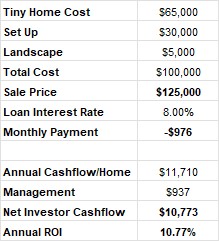

These tables show a nearly 30% return on equity for investors, and construction financing could further boost returns. Individual homes also offer promising returns for investors providing direct lending to tenants:

Table 3: Cost and cash flow analysis for individual homes; assumes delta between sale price and total cost covers sales and loan fees

This model is a generalization, however it's easy to see that creating an affordable community can yield satisfactory results for a private investor. The critical piece of the puzzle, and the key to success, is income: How can a resident afford to make this housing payment?

One possible method that the Bridgeview team explored in-depth was coffee roasting.

In Portland, Oregon, local roasters were open to dedicating 10% of their coffee roasting to such a project, seeing marketing benefits in supporting formerly homeless individuals. Research showed a small onsite coffee roasting facility could generate enough revenue for 100 residents to earn approximately $2,400 monthly working 25 hours per week, demonstrating how simple cottage businesses, backed by community partnerships, can drive significant results.

This approach shows how private markets can create sustainable homeless housing solutions.